What Can They Take During Bankruptcies? Understanding Asset Seizures and Exemptions

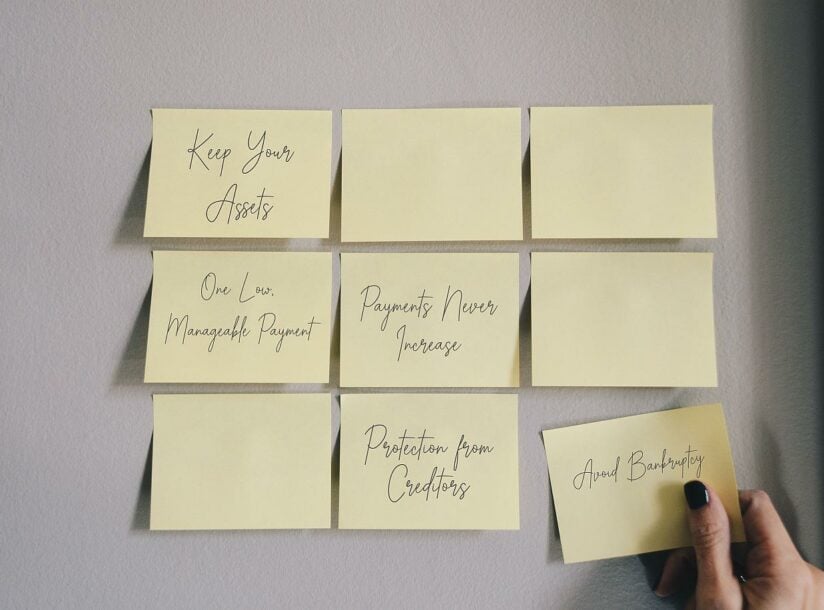

Declaring bankruptcy is a difficult decision, but for those struggling with overwhelming debt, it may be the best path forward. One of the most common concerns when considering filing for bankruptcy in Canada is: of the most common concerns when considering bankruptcy in Canada is: What can they take during bankruptcies? Understanding what you can keep and what may be seized is crucial before proceeding.

Understanding Bankruptcy in Canada

Bankruptcy is a legal process designed to provide relief for individuals and businesses that cannot repay their debts. In Canada, this process is governed by the Bankruptcy and Insolvency Act (BIA) and must be administered by a Licensed Insolvency Trustee (LIT). While some assets may be used to repay creditors, exemptions exist to help individuals maintain essential belongings for daily life.

What Can They Take During Bankruptcies in Canada?

When filing for bankruptcy in Canada, certain assets may be seized to help pay off outstanding debts. However, exemptions vary by province, meaning what you are allowed to keep depends on where you live. Here’s a general breakdown of what assets may be taken:

- Non-exempt Equity in Your Home – If you have substantial equity in your home, it may be sold to repay creditors. However, some provinces have homestead exemptions that allow you to keep a portion of your home’s value.

- Vehicles Over the Exemption Limit – You may keep your car, but if its value exceeds the provincial exemption limit, you may need to pay the difference or surrender it.

- Investments and Savings (Non-Exempt Assets) – RRSP contributions made within the last 12 months, TFSA accounts, and non-registered investments may be subject to seizure.

- Luxury Items – Expensive assets such as jewelry, collectibles, and recreational vehicles may be taken unless they fall within exemption limits.

- Second Properties – A secondary home, cottage, or rental property may be liquidated.

What Assets are Exempt in All Provinces?

Each province and territory in has specific exemption limits to help individuals maintain a basic standard of living. In general, here’s what you are typically allowed to keep:

- Household Furnishings and Clothing – Everyday household items, clothing, and basic furniture are usually exempt.

- A Vehicle (Within Limits) – Most provinces allow you to keep one vehicle up to a certain value.

- RRSPs, RRIFs, and Pensions (Except Recent Contributions) – Retirement savings are mostly protected, except for contributions made in the 12 months before filing.

- Tools of the Trade – If you rely on specific tools or equipment for work, you may be able to keep them within provincial limits.

- Basic Income and Government Benefits – Child tax benefits and some pension payments are protected.

What Assets are Exempt in British Columbia?

- Home Equity – Up to $12,000 in equity ($9,000 in rural areas) may be protected.

- Vehicle – You may keep a vehicle valued up to $5,000 (or $2,000 if you have debts to ICBC).

- Personal Property – Clothing and household items up to $4,000 are exempt.

- Tools of the Trade – Up to $10,000 worth of work-related tools can be kept.

Understanding these exemptions is crucial when considering how to apply for bankruptcies in Canada and what assets you may be able to retain.

Corporate Bankruptcies in Canada

While the focus is often on personal bankruptcies, corporate bankruptcies in Canada follow a different process. Businesses that cannot meet their financial obligations may file for bankruptcy under the BIA, where assets are liquidated to repay creditors. In some cases, restructuring options such as a Division I Proposal under the BIA may be available to help businesses avoid full liquidation.

How to Apply for Bankruptcies in Canada

If you’re considering filing for bankruptcy, follow these steps:

- Consult a Licensed Insolvency Trustee (LIT) – They will assess your financial situation and explain your options.

- Determine Eligibility – You must owe at least $1,000 and be unable to meet your debt obligations.

- File the Necessary Paperwork – Your LIT will help you complete the required documents to officially declare bankruptcy.

- Complete Your Duties – Attend two mandatory financial counselling sessions and provide monthly income and expense reports.

- Receive Your Discharge – If you meet all requirements, you may be discharged in as little as nine months.

Filing for bankruptcy in Canada can provide much-needed debt relief, but understanding what can be taken and what you can keep is essential. Since exemptions vary by province, consulting with a Licensed Insolvency Trustee ensures you make an informed decision. If you’re unsure about the process or need professional guidance, reach out for a free bankruptcy consultation to explore your options.